The Future of Digital Banking: Europe’s Shift from Growth to Endurance (2025 Edition)

- Daniela Fonnegra

- Oct 17, 2025

- 6 min read

Updated: Oct 21, 2025

The European digital banking story is no longer about who can grow the fastest. After a decade of user acquisition races, today’s leaders are proving that endurance, profitability, and strategic positioning are the real markers of success. Updated bank profiles reveal how players are consolidating into three broad paths: the rise of the Super-App Giants, the dominance of SME Specialists, and the reinvention of Incumbents & Infrastructure Builders.

1. The Super-App Giants: Banking Beyond Borders

Some digital banks have outgrown the “challenger” label and now act like global ecosystems.

Revolut has become the blueprint for a financial super-app, with over 60 million users worldwide and a valuation of $75 billion. Beyond payments, it now offers mortgages in Ireland, branded ATMs in Spain, crypto services, AI-powered personal finance assistants, and even global lifestyle perks like travel rewards. Its ambition is clear: to be the all-in-one platform where users live their financial lives, from daily payments to wealth building.

Monzo has taken a more disciplined approach, focusing on sustainable growth in the UK while preparing for a long-awaited IPO. With 13 million customers and strong traction among SMEs, it has turned diversification into its strength—subscriptions, pensions, insurance, and even telecom services. Its 2025 results (revenues of £1.2B, pre-tax profits of £113.9M) show that Monzo is now much more than a trendy pink card—it’s a profitable, mainstream digital bank with community roots.

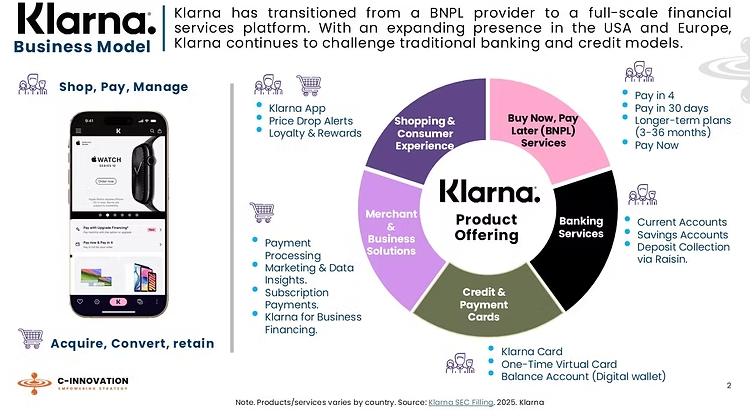

Klarna, once synonymous with BNPL, is rewriting its own story. After going public in the U.S. and raising $1.37B, it is actively transforming into a digital bank and shopping assistant. Its app combines credit, savings, merchant offers, subscriptions (Klarna Plus), and an AI-driven shopping assistant. The vision: to create a closed-loop ecosystem where consumers shop, borrow, and pay—all within Klarna.

🔍 Takeaway: Super-apps are no longer just “challengers”—they are ecosystem builders. Their challenge now is not growth but trust: proving they can balance scale with resilience and compliance.

2. The SME Specialists: Owning the “Missing Middle”

While global giants target consumers, some banks are thriving by focusing on the underserved SME segment—a space neglected by incumbents since the financial crisis.

Qonto has become the benchmark for SME fintechs in Europe. Serving 600,000 businesses across eight countries, it has been profitable for two consecutive years, with net profit of €144M in 2024. Now, by applying for a full French banking license, Qonto is moving from fintech to full-service SME bank—a move that gives it direct lending power and places it alongside Starling and OakNorth as a serious SME banking force.

OakNorth has long branded itself as the bank for the “missing middle”—scaling SMEs overlooked by large banks. With its ON Credit Intelligence platform, OakNorth combines lending with credit-tech licensing, powering banks worldwide with smarter risk assessment. It has already lent over £17B in the UK, supporting 61,000 jobs and 36,000 homes, while achieving consistent profitability. Its U.S. expansion via partnerships and a potential IPO show it is balancing both tech and banking with equal weight.

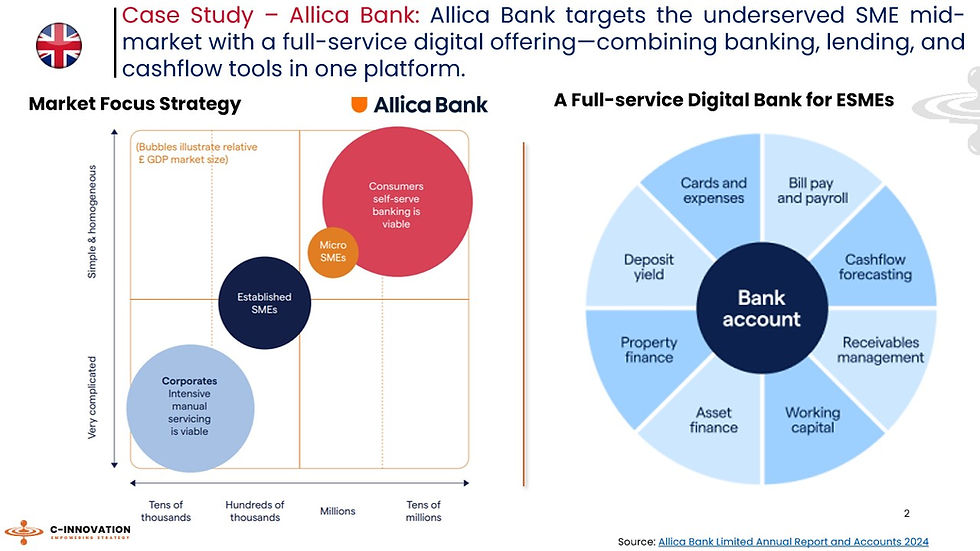

Allica Bank is proving that business banking can be both digital and personal. Targeting established SMEs, it pairs a relationship manager with a cloud-native platform, giving clients the trust of traditional banking with the speed of fintech. By 2024, it had surpassed £3B in SME lending and £4B in deposits, and was named the UK’s fastest-growing startup. Its hybrid model positions Allica as the modern equivalent of “relationship banking—just better.”

Starling Bank is a rare case: both a profitable retail challenger and a platform licensor. Its “Engine by Starling” BaaS arm exports its proprietary core banking system to fintechs and banks abroad, creating a second growth engine beyond its 4.2M UK customers. With revenues of £714M and £223M profit before taxes in 2025, it is showing how a neobank can scale balance-sheet growth at home while monetizing technology abroad.

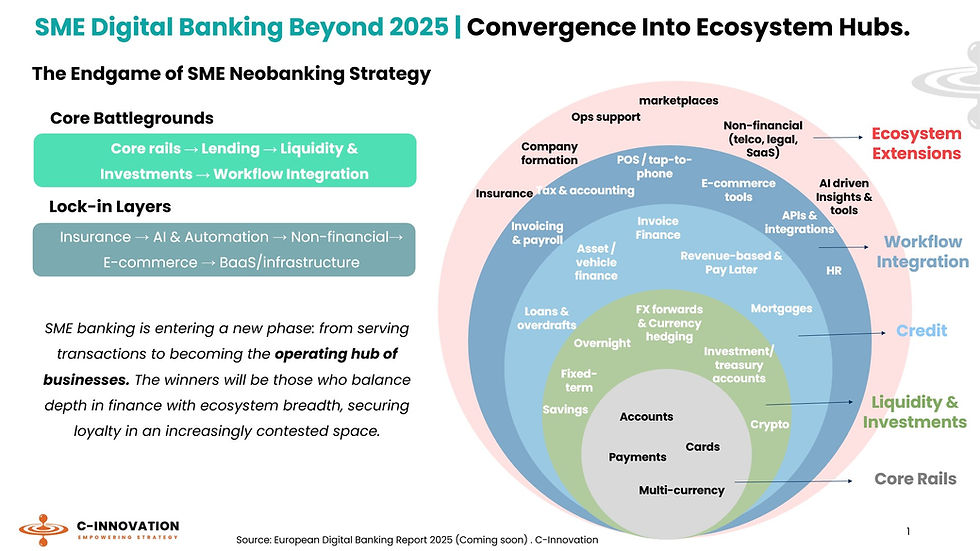

🔍 Takeaway: SME banking is no longer niche—it’s becoming the anchor of profitability for digital banks, proving that loyalty and lending depth can outperform user-chasing growth models.

3. Incumbents & Infrastructure Builders: Reinvention in Motion

Digital transformation is not limited to challengers. Some incumbents and infrastructure-led players are redefining what it means to be a digital bank.

Boursobank, formerly Boursorama Banque, is now France’s largest digital bank with nearly 8M clients. Backed by Société Générale, it integrates full retail banking, insurance, and investing under one sleek platform. Its rebrand was more than cosmetic: it was about positioning itself as the flagship digital brand of an incumbent, proving that legacy banks can succeed in the digital-first era.

BBVA Digital Bank (Italy) shows how global incumbents defend their edge. Leveraging decades of regulatory and operational strength, BBVA’s digital-first approach allows it to blend compliance with user-friendly fintech experiences, making it one of the most credible incumbent-driven digital players.

Wise stands out as the “utility layer” for cross-border finance. With 15.6M customers and £145B in annual transfers, Wise is embedding its API rails into banks, fintechs, and even Google Pay. Unlike most neobanks, it thrives without a banking license, relying on local payment rails and transparency (“money without borders”) as its brand promise. Its upcoming U.S. listing underscores its ambition to scale as a global financial infrastructure player.

Lunar, operating in Denmark, Sweden, and Norway, has grown to 1M+ customers and is now moving beyond retail into infrastructure. With the launch of Moonrise, it offers real-time payments APIs to fintechs and corporates across the Nordics. By combining consumer banking with infrastructure monetization, Lunar positions itself as both bank and enabler in one of the world’s most digitized regions.

bunq, the Dutch “Bank of The Free,” is proof that independence can pay off. With 11M (today 20M) users and €85M profit in 2024, it is expanding into the UK and preparing for the U.S., all while emphasizing sustainability (millions of trees planted with its Green Card program). Bunq shows that self-funded, mission-driven models can thrive against both incumbents and venture-backed rivals.

Hype, Italy’s first mobile-native bank, has evolved from prepaid card to full digital ecosystem. Backed by Banca Sella and illimity Bank, it now serves 1.9M customers with savings, credit, and insurance—while also offering Banking-as-a-Service APIs to partners. Its blend of fintech agility and institutional support makes it a case study in successful collaboration.

🔍 Takeaway: Incumbent-backed and infrastructure-led models remind us that the future of banking isn’t only in consumer apps—it’s in rails, licenses, and ecosystems.

C-Innovation Analysis | From Challenger Speed to Enduring Strength

The age of the challenger bank is over — and that’s a good thing. What began as a race for users has evolved into a contest of staying power, strategy, and substance. The latest wave of updates across Europe’s leading digital banks shows an industry growing up fast — one where growth is no longer measured by sign-ups but by sustainability, trust, and real economic impact.

1. Super-Apps Shift from Expansion to Accountability

Revolut, Monzo, and Klarna have graduated from challenger status to ecosystem orchestrators. Their playbooks now stretch far beyond banking — blending credit, investments, lifestyle services, and AI-driven personalization into unified financial hubs. But with great scale comes scrutiny. The next phase for these giants isn’t about adding products; it’s about earning trust at scale — proving that they can operate with the same rigor and resilience as the incumbents they once sought to disrupt.

2. SME Banking Emerges as the True Profit Engine

While the giants go global, SME specialists are quietly defining digital banking’s most stable business model. Qonto, OakNorth, Allica, and Starling show that loyalty and lending depth trump virality. By mastering credit and embedding technology into business workflows, these players are building financial partners, not just products. Their results confirm a clear truth: in 2025, the SME segment is where fintech innovation finally meets profitability.

3. Incumbents and Infrastructure Builders Rewrite the Rules

Legacy isn’t a liability anymore — it’s a launchpad. The transformation of Boursobank, BBVA Digital Bank, and Hype proves that incumbent DNA can thrive in digital form when paired with focus and agility. Meanwhile, infrastructure players like Wise, Lunar, and bunq remind us that some of the most powerful brands in banking don’t even need to “look” like banks. Their business is the rails — the APIs, data layers, and cross-border networks powering the next generation of financial services.

4. The New Currency: Credibility

The defining advantage in digital banking is no longer speed — it’s credibility. As regulators tighten oversight and investors demand clearer paths to profit, the winners will be those who blend innovation with discipline. Licensing strength, ecosystem control, and segment expertise are becoming the three currencies of endurance.

5. The Big Picture

Digital banking in 2025 is not slowing down — it’s maturing. The question is no longer “who’s next?” but “who will last?” Europe’s leaders are proving that sustainability is the new disruption. The next wave won’t be built on hype, but on resilience, regulation, and relevance.

🔗 Discover more insights in C-Innovation’s upcoming European Digital Banking Report 2025 — where we map out the strategies shaping the next phase of growth.

Comments