SME Bank and the Future of SME Finance: From Lending to Partnership in the Age of AI

- Daniela Fonnegra

- Oct 8, 2025

- 5 min read

Podcast with Thorsten Seeger, Management Board Member at SME Bank

SME banking has long been described as the “missing middle” of finance. While large corporates often enjoy tailored banking relationships and consumers benefit from standardized retail products, small and mid-sized enterprises have historically faced gaps in access, cost, and personalization. Over the past two decades, this space has been reshaped by regulatory reforms, digital challengers, and new infrastructure that reduced barriers to entry. What began largely as lending solutions has steadily expanded into integrated banking platforms offering payments, working capital, FX, and accounting integrations.

Today, SME banking is at an inflection point. Traditional banks are under pressure to modernize legacy systems and processes, while digital challengers are positioning themselves as ecosystem partners—embedding financial services directly into the workflows of SMEs. The evolution is moving from transactional banking to strategic partnership, where credit is just one piece of a broader toolkit enabling growth, resilience, and efficiency.

👉 That is exactly what further insights from our upcoming European Digital Banking Report 2025 will explore in detail. Discover more here.

In our recent podcast conversation with Thorsten Seeger, member of the management board at SME Bank, we explored how a bank born out of a Lithuanian lending platform has expanded into one of Europe’s most ambitious SME-focused challengers. Yet what stands out from the discussion is not simply the story of SME Bank itself, but the broader questions it raises for banking in Europe and globally.

Should banks remain mere lenders, or should they evolve into full operational partners for small and mid-sized enterprises? And how can artificial intelligence and automation finally deliver the efficiency and inclusivity that SME finance has lacked for decades? These are not peripheral debates. They sit at the heart of the transformation underway in global banking.

Beyond Lending: The Bank as an Operational Partner

For decades, the bank–SME relationship revolved almost exclusively around credit. SMEs came to banks for loans, overdrafts, or working capital lines, and the interaction often ended there. Seeger, however, points to a new model: one where lending is just the entry point to a much deeper relationship. As SMEs grow, their needs extend far beyond financing—they require treasury tools, invoicing solutions, FX management, payroll services, and integrations with accounting systems. To remain relevant, banks must embed themselves into this daily financial and operational reality.

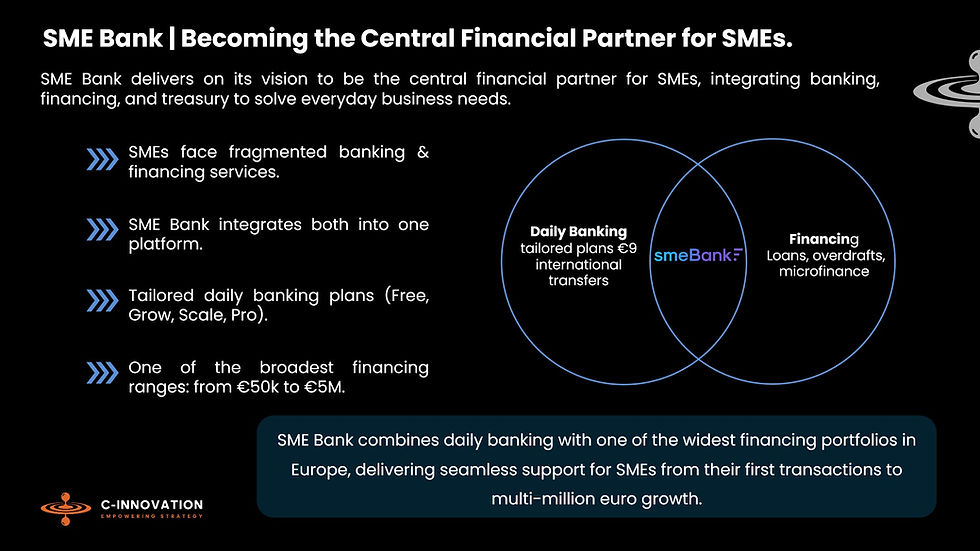

“Our vision is to become the central financial partner for SMEs across Europe… not just by offering loans or current accounts, but by really solving the broader pain points when it relates to daily banking, treasury and business operations.”

-Thorsten Seeger

This vision is not theoretical. In Europe, new entrants are already bundling traditional banking with digital-first services such as multi-currency accounts, international payments, and accounting integrations. Their aim is not simply to sell a loan, but to become the central financial partner of the business. In Latin America, fintechs like Mexico’s Konfío illustrate a similar shift: what began as a credit-first fintech has evolved into an ecosystem that provides both financing and enterprise software. By combining loans with billing tools, expense management, and point-of-sale systems, Konfío demonstrates how banks—or fintechs acting like banks—can secure far greater loyalty by solving real operational pain points.

The implications are profound. If SMEs use their bank not just to borrow but also to issue invoices, run payroll, or reconcile accounts, switching costs rise dramatically. Loyalty becomes less about interest rates and more about integration into the workflow of the business. In this sense, the competition is shifting: the decisive factor is not “who lends cheapest” but “who embeds deepest.”

Efficiency as a Competitive Edge: AI in SME Lending

Yet none of this matters if credit itself remains slow, cumbersome, and inaccessible. As Seeger explained, SME Bank has made it possible to deliver lending decisions in under 24 hours—an impressive benchmark compared to most incumbents that still take days or weeks. Achieving this kind of responsiveness requires a fundamental redesign of the credit process, where technology does not replace humans but amplifies their expertise.

Artificial intelligence and automation now enable banks to accelerate every stage of the credit journey. Onboarding can be streamlined through digital KYC and open banking connections; risk assessment can be enriched with alternative data sources ranging from supplier payment histories to tax filings; and analyst productivity can be boosted by automating tasks that previously consumed entire workdays, such as drafting credit memoranda. The result is not “AI-first for the sake of AI,” but AI deployed where it reduces friction and increases value.

“The way we use this technology allows us to actually make lending decisions in generally under 24 hours… being able to do the majority of cases in such a short time is so important.”

-Thorsten Seeger

Importantly, this is not just about speed. In Latin America, where the SME financing gap is estimated at over $1.2 trillion, efficiency is directly linked to inclusion. When banks can process applications faster and with better data, they can extend financing to thousands of SMEs previously excluded by slow, manual, and high-cost evaluation methods. The same holds true in Europe, where fintech challengers are forcing incumbents to match the immediacy of digital lending. In both contexts, AI is no longer optional—it is the baseline for relevance.

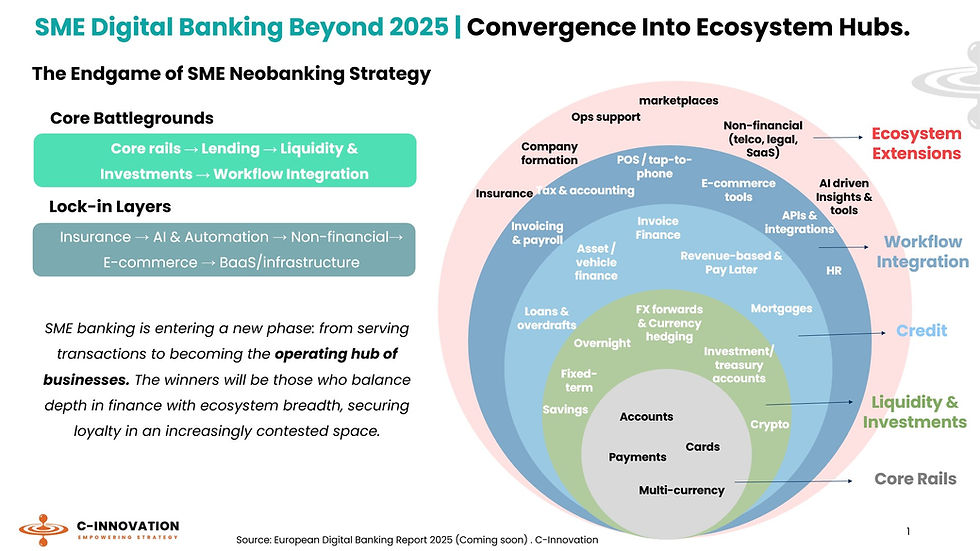

Strategic Takeaway: SME Banking Converging Into Ecosystem Hubs

What Thorsten Seeger shared about SME Bank’s journey—from a lending-first model to becoming a full operational partner—mirrors the broader shift we are tracking in our European Digital Banking Report 2025. SME banking is evolving into ecosystem hubs where financial depth and operational breadth reinforce each other.

Source: Preliminary findings European Digital Banking Report 2025. C-Innovation

As our model shows, the progression moves outward from core rails (accounts, payments, cards) into credit, liquidity, and investment layers, then into workflow integration (invoicing, payroll, accounting, HR), and finally to ecosystem extensions (non-financial services, marketplaces, AI-driven tools). Each layer not only adds value but also increases stickiness, making banks true operating partners rather than transactional providers.

The implications for SME finance are clear:

Depth + Breadth Wins – Success will come to those who can balance strong financial products with ecosystem extensions.

Switching Costs Rise – When SMEs embed payroll, FX, and invoicing into their bank, loyalty is secured far beyond pricing.

AI as an Enabler – Automation and data insights are not peripheral, but central to delivering both efficiency and integration at scale.

Avoiding Commoditization – Operational partnership without efficient lending risks frustration, while efficient lending without broader integration risks commoditization. The winners will master both.

For Europe and globally alike, the message is clear: the SME bank of the future will not be judged solely by the volume of capital deployed, but by how seamlessly it integrates into the entrepreneur’s daily life—and how quickly it can respond to financial needs. Those that combine ecosystem breadth, financial depth, and AI-powered efficiency will set the standard for the next decade of SME finance.

Tune In and Stay Engaged

Join us as we embark on a transformative journey through the realm of financial innovation. Your seat at the forefront of FinTech awaits.

Corporate subscribers gain early access to the European Digital Banking Report 2025, along with our library of deep-dives on 90+ digital banks — all enhanced by our AI Assistant to explore insights, compare strategies, and answer your questions in real time.

Comments