Navigating the New Frontiers of Digital Banking: 5 Trends Shaping May–June 2025

- Javier Guevara

- Jun 23, 2025

- 5 min read

At C-Innovation, we track more than just movements in the digital banking space—we uncover the strategic shifts that define tomorrow’s leaders. This blog is based on our May–June 2025 Digital Banking Trends document, available to C-Innovation members here.

In the digital banking space—we uncover the strategic shifts that define tomorrow’s leaders. Over May and June 2025, we observed five powerful trends reshaping the digital banking landscape. From embedded AI to IPO ambitions, these trends reveal how digital challengers are maturing into full-scale platforms. Here’s our deep dive into the signals that matter.

1. Lifestyle Banking Platforms: From Finance to Everyday Utility

Digital banks are no longer just financial service providers—they’re becoming lifestyle platforms. In Latin America, Nubank leads this charge with the expansion of NuCel (mobile), travel-focused eSIMs, NuShopping, and price alert features—all integrated within a seamless financial app. Similarly, Revolut now offers eSIM data in over 100 countries, travel bookings, insurance, and subscriptions—making the app an essential companion beyond banking.

Klarna's evolution is also noteworthy. Its 2024 launch of phone subscriptions alongside AI-driven shopping assistants transformed it into a commerce infrastructure player. By serving 93 million users and 675,000 merchants, Klarna has turned lifestyle integration into a profitable model, generating $2.8 billion in revenue and returning to profitability.

Mercado Pago is also moving deeper into financial services. Traditionally positioned as a lifestyle-centric payments player, it is now seeking a banking license—highlighting how commerce and lifestyle platforms are converging with core banking.

These services do more than just add value—they anchor users in a daily-use ecosystem. As banking fades into the background, lifestyle services become the new entry point to digital relationships.

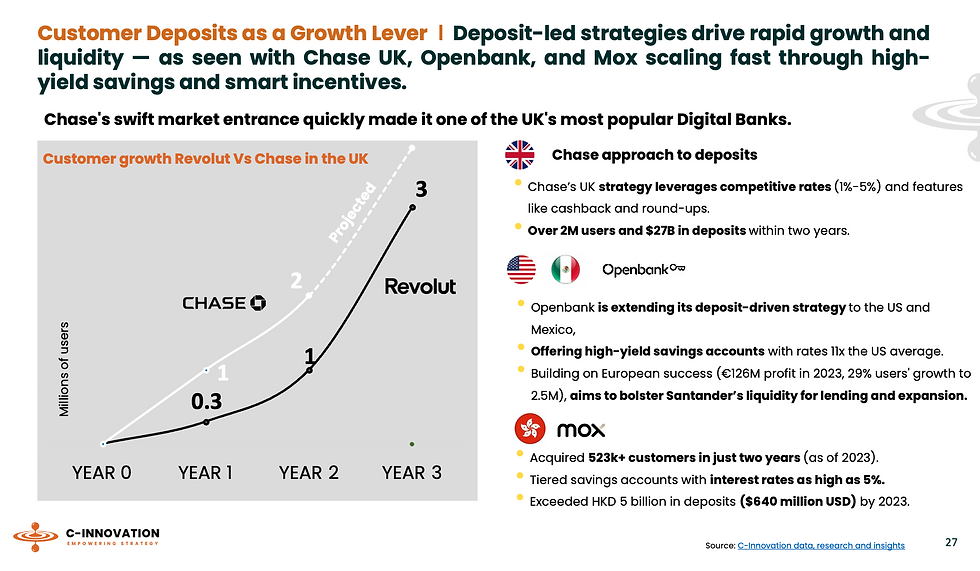

2. Strategic Growth Stacks: Deposits + Product Layering for Scalable Expansion

Neobank growth is increasingly anchored in four mutually reinforcing pillars: global expansion, diversified offerings, deposit-driven scale, and strategic partnerships. Together, these elements form a resilient foundation for sustainable profitability. Digital banks that build around this structure are positioning themselves not only for revenue growth but also for ecosystem dominance.

Global Expansion unlocks new customer bases, diversifies revenue, and establishes competitive positioning in emerging and mature markets.

Diversified Product Offerings enhance customer stickiness and open new income streams.

Customer Deposits act as a lever for stability and liquidity, powering credit and trust.

Partnerships and Strategic Acquisitions enable faster market entry and operational growth.

The most resilient digital banks are those converting customer trust (deposits) into durable engagement through modular product stacks. Chase UK exemplifies this with $27 billion in deposits—powered by cashback and round-up features—and a roadmap that expands into lending, wealth, and credit. Openbank is taking a similar route with strategic moves into the U.S. and Mexican markets.

Monzo's growth strategy is also instructive. It started with current accounts and has since expanded into pensions, shared accounts, investment features, and smart UX enhancements like undoing payments. Nubank followed a structured product evolution: card → credit → savings → telco → lifestyle.

This layer-by-layer expansion creates predictable engagement loops, higher ARPU, and a defensible ecosystem. The goal isn’t just feature parity—it’s ecosystem primacy.

3. IPO Momentum and Global Reach: Aligning Markets, Capital, and Confidence

We anticipated it—Chime and Klarna filed, and Monzo is preparing. Our earlier research accurately mapped the trajectory of IPO readiness across leading digital banks. From low to high readiness, neobanks like Revolut, Lunar, Monzo, and Bunq are now aligning platform maturity, user base, and revenue scale with capital market expectations.

As our 2023–2024 IPO Readiness Map showed, readiness isn't just about revenue—it's about profitable growth, investor confidence, regulatory maturity, and market visibility. Chime’s $18.4B Nasdaq filing and Klarna’s return to profitability were predictable outcomes of their evolving growth stacks and disciplined expansion.

With revenue growth and international expansion reaching critical mass, digital banks are increasingly preparing for IPOs. In May, Chime filed for its long-anticipated Nasdaq IPO, valued at $18.4 billion with 8.6 million users and $1.6 billion in revenue. Monzo, having reached profitability and 48% YoY revenue growth, is next in line.

Revolut continues to act like a global player, with its Western Europe hub aiming to generate €1 billion in revenue and new expansions into Israel and Mexico. Klarna, after its AI-driven cost transformation, has signaled IPO readiness too. Meanwhile, Wise is shifting its primary listing to the U.S., aligning capital access with its customer base and regulatory favor.

IPO momentum is more than financial performance—it’s about platform maturity, investor trust, and readiness to scale with institutional backing.

4. SME Banking Renaissance: A Digital-First B2B Transformation

Digital banks are rediscovering the SME segment—not as an add-on, but as a core growth driver. OakNorth stands out with its credit intelligence platform powering $1 billion in SME loans, and its strategic U.S. expansion supported by an acquisition and a New York office. Qonto, meanwhile, is winning the French and European SME market with embedded payments (Tap to Pay, Payment Links) and a platform-first approach.

Starling Bank continues to scale SME lending profitably, while LendingClub merges business lending with personal financial tools. Even SoFi, traditionally consumer-focused, has begun bundling features for small business owners through its SoFi Plus model.

What unites these players is their focus on tailored, tech-first offerings—fast onboarding, 24/7 support, integrated POS and payments—designed for the digitally fluent entrepreneur.

Source: Strategies for Growth: Navigating the USA Digital and Neo-Banking Landscape. C-Innovation. 2024

US digital banks are also innovating product strategies for SMEs. Brex and Bluevine focus on high-yield accounts and credit for startups, while Square and Mercury simplify POS and cash management. Venmo and LendingClub offer integrated business payments and lending. Their user-friendly platforms, 24/7 support, and flexible financial tools reflect a strong pivot toward B2B specialization.

5. Embedded & AI-First Future: From App to Ambient Experience

The next leap in digital banking won’t be app-based—it’ll be embedded, invisible, and intelligent. Visa is leading the way with AI-powered financial agents and embedded commerce layers. Google’s Gemini sets a benchmark for smart interfaces that enable predictive, natural-language interactions with financial data.

Learn more: Banking in 2030 – Intelligent, Inclusive, Invisible. C-Innovation. 2024

Monzo’s Undo Payment feature is already a leap forward in UX, using real-time correction to drive trust. OakNorth uses AI to optimize credit outcomes, and Wealthfront continues to automate money management through predictive modeling. SoFi, too, is layering AI insights across its app to drive smarter engagement.

C-Innovation sees the future of digital banking unfolding as an AI-first, embedded ecosystem, where physical touchpoints are selectively reintroduced and digital platforms are integrated seamlessly into daily life. For example, Revolut’s push to open strategic physical branches highlights the evolving hybrid model for trust and presence. Meanwhile, X (formerly Twitter) is bringing Elon Musk’s 2022 payments vision to life with “X Money,” which includes P2P payments, debit cards, and Visa integration—turning the social app into a full-fledged fintech ecosystem.

The result? A shift from transactional banking to ambient financial companionship—where smart agents work behind the scenes to anticipate needs, flag risks, and enhance life.

Final Thought: The Platform Race Is On

From May to June 2025, we’ve seen digital banks move from feature-building to platform-building. Whether through AI, lifestyle integration, SME focus, or IPO planning, the best are aligning operational strength with strategic foresight.

The digital banks that win the next decade won’t just offer better apps—they’ll be platforms embedded in your life, running on intelligence, trust, and ambition.

Financial performance alone is no longer enough. Success will be measured by ecosystem control, adaptability, and the ability to deliver seamless, invisible value across lifestyle, business, and financial interactions. The race is on—and it’s being led by those who embed themselves into every context where money matters.

At C-Innovation, we continue to monitor how financial institutions are adapting — and we empower our clients with the insights to lead, not follow.

🔗 Learn more: Access to the client area

Comments